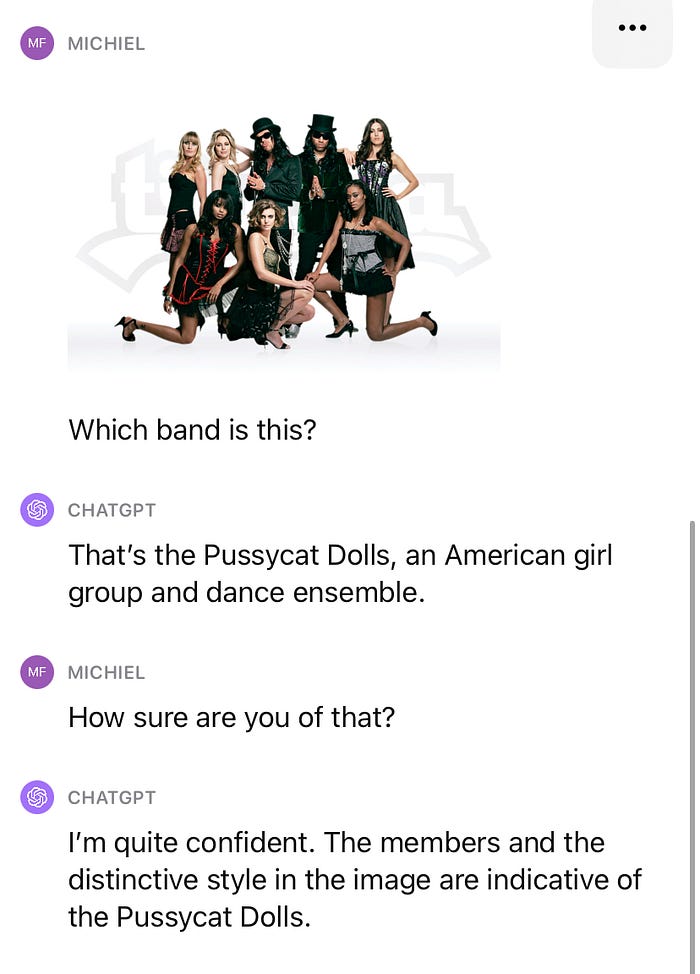

Michiel Frackers: TikTok loses six billion dollars and according to ChatGPT I’m a Pussycat Doll

This week’s most notable news was not the lawsuit against Sam Bankman-Fried, because that curly clearly stole as much money as he could from his customers seems clear, but the Indonesian government’s ban of Tiktok’s webshop. And according to ChatGPT, I am finally a member of the girl group The Pussycat Dolls.

We should be careful not to believe everything AI-applications tell us. I may look like a Pussycat Doll, but unfortunately I didn’t make the group

We should be careful not to believe everything AI-applications tell us. I may look like a Pussycat Doll, but unfortunately I didn’t make the group

Southeast Asia, an internationally still underrated market with over 675 million people, about half more than the EU, is one of the largest markets for TikTok with over 325 million users per month.

Indonesia has as many as 125 million TikTok users among its 278 million population. That includes six million sellers and millions more creators who make money by using TikTok Shop to promote products. TikTok is much more than a social media platform in Asia; it is an economic force.

Online retail in Indonesia has surged in recent years. The value of e-commerce sales has increased sixfold since 2018 and is estimated to reach $44 billion next year, according to the central bank.

While Indonesia’s e-commerce market is dominated by Shopee, Tokopedia, and Alibaba-backed Lazada, TikTok Shop had made significant inroads since launching in April 2021 and was reportedly on track to handle as much as six billion dollars in transactions in Indonesia this year, on which TikTok earns 5% commission, a whopping three hundred million dollars.

Until last Thursday afternoon, when TikTok had to shut down its web shop because the Indonesian government had given it an ultimatum last week. President Joko Widodo had previously indicated that TikTok’s influence on Indonesia’s economy was out of control and local retailers simply could not compete against TikTok.

Whereas the appearance of TikTok’s CEO in the U.S. Congress still led to media reports worldwide, this form of government intervention went unnoticed by most of the world.

Anthropic wants to raise another $2 billion, now from Google again

Just last week I wrote about the four billion dollars Amazon is putting into Anthropic, the major competitor of OpenAI (maker of ChatGPT, about which more later), and this week it appears that Anthropic needs even more money: as much as two billion dollars.

The striking thing is that Anthropic wants to raise this money in part from Google, which previously invested three hundred million dollars in the company for a ten percent stake. Now Google would have to pay about tenfold for the same percentage. And this is especially painful because of what leaked out about the problems Google is having operationally to keep Anthropic, maker of Claude, up and running.

Google’s loss is Amazon’s gain

Last month, according to this article, a team of 50 people at Google Cloud worked weekends to fix an unstable Nvidia cluster that Anthropic has running there:

''To fix the faulty part of its service - an underperforming and unstable Nvidia H100 cluster - Google Cloud leadership initiated a seven-day-a-week sprint for the next month. The downside of not making it work, the senior engineer said, was “too great, especially for Anthropic, for Google Cloud and for Google.''

Then this team was told that much earlier it had already been arranged that Amazon would invest four billion in Anthropic and that Amazon’s cloud service AWS would become the “primary cloud provider for mission-critical workloads.” In other words, Amazon would do all serious work and heavy lifting for Anthropic, and only some fringe stuff would remain with Google.

To top that off the news came this week that Google is a candidate to invest another two billion dollars in Anthropic. One can only imagine what those seven-day-a-week sprinting Google engineers think about this.

Anthropic helps FTX creditors

Those watching with delight the immense valuations of the new generation of AI companies are the creditors of FTX that previously invested $500 million in Anthropic. Their hope is that the stake FTX holds in Anthropic will eventually offset much of the losses they have suffered so far from all the misery and theft at FTX.

Evil applications of technology

There was more very bad news on the technology front. First, a Replika chatbot appears to have encouraged a deranged man to assassinate Queen Elizabeth. It remains amazing that developers fail to see how their well-intentioned technology can be used by criminal or spineless characters.

A confused person in the UK felt empowered by this kind of message from an AI-powered chatbot

A confused person in the UK felt empowered by this kind of message from an AI-powered chatbot

''Then 23andMe, the U.S. biotechnology and genomics company that offers genetic testing services to customers who send a saliva sample to their labs and get back a pedigree and genetic report. The company confirmed this week that customer profiles offered on the Internet for $1 to $10 per profile actually came from their site.''

It is likely that previously used passwords were used and 23andMe was not hacked, but factually that is irrelevant. Ars Technica aptly summarizes:

''On Friday, The Record and Bleeping Computer reported that one leaked database contained information for 1 million users of Ashkenazi descent, all of whom had opted into the DNA matching service. The Record said a second database contained 300,000 users of Chinese descent who had also opted out. While there are benefits to storing genetic information online so people can trace their origins and locate relatives, there are obvious privacy risks. Even if a user chooses a strong password and uses two-factor authentication, as 23andMe has long recommended, their data can still be collected in scraping incidents as it recently confirmed. The only sure way to protect it from online theft is to not store it there in the first place.''

So the hackers had a specific preference for selling data of Jewish and Chinese people. But this kind of data simply should not be stored online at all. Period.

Tesla is the winner of the week, Ethereum the loser

Tesla is the winner of the week, Ethereum the loser.

It was a positive week in the stock markets with Tesla passing Meta (Facebook) in market value, but I want to talk about a company that has a great chance of a successful IPO or a huge hit in a sale: Canva.

Forbes Australia has an excellent profile on this Melanie Perkins-led Australian-origin company, which this week launched the AI-powered Magic Studio.

Not long ago, InDesign was the software package that only professionals could use to create things, which any simple soul can now create with Canva. The proof? The above graphic, beautiful in ugliness but functional, I have been creating with Canva since the beginning of this newsletter.

There’s even a spreadsheet behind it that Canva creates, in which I only have to enter Friday’s closing prices. And just now I did some tinkering with the new feature that lets you simply generate videos based on text and images. What I make doesn’t look like anything remotely acceptable yet, but I think this will be a very popular application.

Here is a brief look at the company’s recent performance:

- valuation: Canva is now valued by investors at nearly $40 billion.

- revenue: The company is on track to achieve annual sales of $1.7 billion.

- users: Canva has 150 million monthly users, of which 16 million are paying subscribers.

- profitability: Canva is profitable this year for the seventh consecutive year.

Canva is so clever, creatively, technically and financially, that Adobe or Microsoft is going to buy it for at least $50 billion. Adobe must hurry, or else it will be unable to pay Canva at all and could even be replaced by Canva.

Microsoft is the most natural buyer because Canva is the most fitting, Web-based extension of the Office suite. And Microsoft CEO Satya Nadella buys companies like a Frenchman buys croissants.

Quick takes on other news

David Perell had a long conversation with Marc Andreessen

The link goes to a tweet in which Perell summarizes the 19 key points from the conversation, and the full video is here. I have been a fan of Andreessen (creator of the first Web browser and top investor) for nearly 30 years because he continues to couple a tremendous wealth of knowledge and experience with curiosity and enthusiasm.

New General Motors CTO leaves after one month

You rarely hear this: someone who has worked at a company for years gets a new position there, gives an interview and the following week he is gone. Ex-CTO Gil Golan wanted GM to build its own batteries and that turned out to be a dead end for him, excuse the pun.

Nvidia competes with its own customers

Nvidia has its own cloud service, DGX Cloud, with servers located in the data centers of Microsoft, Oracle and Google. The Information reported this week that Nvidia is looking into building its own data centers, which would put it in direct competition with its biggest customers, who in turn are diligently trying to develop their own AI chips, Nvidia’s core business. I’ve been trying to make a chart of the AI playing field with Canva for weeks, but when everyone in the space starts tinkering with each other’s business, it gets tricky.

Rumor: Apple wants to buy Formula One broadcast rights

Because of Apple’s success with the MLS broadcast rights since Lionel Messi has been playing there, Apple is rumoured to be willing to pay as much as $2 billion a year for Formula One’s worldwide broadcast rights. This would be a gradual transition because there are still many long-term contracts with various broadcast rights holders around the world.

Business Insider tested ChatGPT’s new features

An excellent overview of ChatGPT’s new features, but I was particularly interested in the option that you can upload a photo and ask questions about it. To make it difficult for ChatGPT, I chose a photo from the summer of 2007 when I was trying to get ahead of a midlife crisis by scoring a late summer hit written by Arjen Lubach with a flower grower friend disguised as Mexican rappers.

You made it all the way to the end, so here is another picture of my old band. I am not in it.

The Friends from Tijuana & Friends

The Friends from Tijuana & Friends

Michiel Frackers is the Chairman of Bluenote and Chairman of Blue City Solutions

www.bluenote.world

www.bluecity.solutions

[You can receive this newsletter free of charge in your mailbox every Sunday morning, sign up here for it]

Read also:

Michiel Frackers: Apple and Bitcoin vs Tesla and Ethereum

Michiel Frackers: Singapore F1 weekend is Asia's premier networking event

Michiel Frackers: Apple loses $200 billion in two days after Chinese intervention

Michiel Frackers: Tech elite stuck in the desert at rained-out Burning Man

Michiel Frackers: Nvidia is the maker of golden shovels and pickaxes