This week, two seemingly incomparable conferences took place: Singaporean sovereign wealth fund Temasek organized EcoSperity in Singapore and Token 2049 , the biannual party of crypto fans, was held in submerged Dubai. In Dubai it was mainly about Bitcoin and in Singapore about carbon credits. Two opaque, moderately regulated markets that nevertheless attract billions from investors because of their undeniable usefulness.

I myself was in Singapore at the Climate Summit 2024 , part of EcoSperity, organized by Temasek subsidiary GenZero, which is trying to make investments that combat climate change with five billion dollars. This climate conference last week often focused on the doubts that have arisen in the ' climate tech sector ' about the quality of carbon credits since The Guardian and Die Zeit published damning articles about them last year.

Instead of phasing out fossil fuels, years have been wasted and a huge amount invested in the vague carbon offset schemes that trade, limit and capture carbon without actually reducing the CO2 emissions that are causing global warming.

The voluntary carbon market ( VCM ) is estimated to be around $2 billion per year and consists of a complex network of developers, registries, traders, brokers and investors, making it difficult to assess the effectiveness of establish compensation projects.

An arid park does not remove CO2

Earlier, comedian John Oliver, the English-speaking counterpart of Arjen Lubach but with worse hair, criticized the air cycling in carbon credits in his show Last Week Tonight , which mainly arose after COP21, the climate conference in Paris. In 2015, almost two hundred countries agreed that carbon credits are the most important instrument for limiting global warming to one and a half degrees.

I attended COP21 in Paris for a few days and spent hours listening to experts explain how the 'limit and trade' system would lead to lower CO2 emissions, but I understood little of it. Unfortunately, rightly so, as research shows that forestry offset projects, approved by the world's largest certification bodies and used by Disney, Shell, Gucci and other major companies, are largely worthless and could actually worsen global warming.

The recent critical media noise has had a great effect, because the time when a clever dictator could point out a barren park from which the non-existent carbon credits were then sold several times to, for example, an unsuspecting European farmers' loan bank, after which the trees were still cut down and the wood sold , seems to be gone forever.

The future belongs to carbon removal credits

There is broad consensus that offsets should only compensate for emissions that are impossible to avoid. However, the focus must be on ways to permanently remove CO2 from the atmosphere, because limiting emissions alone is not enough. Projects that permanently remove CO2 do not yield carbon credits, but the much more relevant carbon removal credits.

Precisely because of the creation of carbon removal credits, Morgan Stanley, among others, expects that the carbon credits market will increase fiftyfold to a hundred billion dollars by 2030 . The idea is simple: carbon is becoming increasingly expensive, because it is taxed more heavily, which in combination with higher quality carbon removal credits will lead to much more demand at a higher price imposed by governments.

With apologies for all the abbreviations, because people in this sport prefer to say that their lupa is in the liboza instead of a packed lunch in the top left pocket, but good examples of carbon removal projects are:

- Bioenergy with Carbon Capture and Storage (BECCS): This technology captures CO2 emissions from biomass power plants and stores them underground.

- Direct Air Capture (DAC): These are technologies that capture carbon dioxide directly from the air. The captured carbon can then be stored underground or used to produce low-carbon fuels.

- Ocean fertilization, or oceanic fertilization (OF): Oceanic fertilization involves adding nutrients, usually iron, to the ocean for the purpose of stimulating phytoplankton growth; and for those who, like me, are not completely familiar with the magical world of phytoplankton, which are microscopic sea plants that absorb carbon dioxide through photosynthesis. When these phytoplankton die and sink to the ocean floor, they can carry the captured carbon and store it for long periods.

Although more research needs to be done into possible long-term effects of ocean fertilization, it appears to be a very cheap and effective way to remove carbon and combat global warming.

For those who want to know more about the need for carbon credits and the issues surrounding their quality, I have written this article with short summaries of seven relevant publications from Morgan Stanley, Harvard Business Review and S&P Global, among others.)

How do we realize and finance CO2 capture?

As they approach their target dates for net zero emissions, companies are increasingly turning to carbon credits to meet their targets. However, at the moment the market for carbon credits, at the aforementioned two billion dollars worldwide, is far too small to reduce the full impact of companies on the environment.

Climate startups need much more funding to develop their technology . Companies need to become financiers of carbon removal technology earlier and commit to becoming future customers, said Meghan Sharp of Decarbonization Partners , a joint venture between BlackRock and Temasek.

It initially seemed strange that Sharp, which manages the billions of two of the world's largest investors, is calling on other companies to finance climate technology developers. But she had a point, which was illustrated by Henrik Wareborn of sustainable fuels technology company Velocys .

Wareborn signed a 15-year purchasing agreement with Southwest Airlines. This agreement was signed in November 2021, years before Velocys' biorefinery will supply fuel commercially. Southwest Airlines is actually financing the creation of climate technology that it will use itself.

As a second example, Sharp cited a multibillion-dollar loan from the U.S. Department of Energy to Monolith , a clean hydrogen and materials company funded by Decarbonization Partners. This money allowed Monolith to expand its production facilities in Nebraska and welcome Michelin and Goodyear, two of the world's largest tire manufacturers, as customers.

“ This is an example of how companies can also play a role, not by financing the project itself, but by making the project safer and more investable through these types of off-take agreements.” Sharp said. After all, investors will be more likely to invest in a startup that already has turnover guarantees from multinationals.

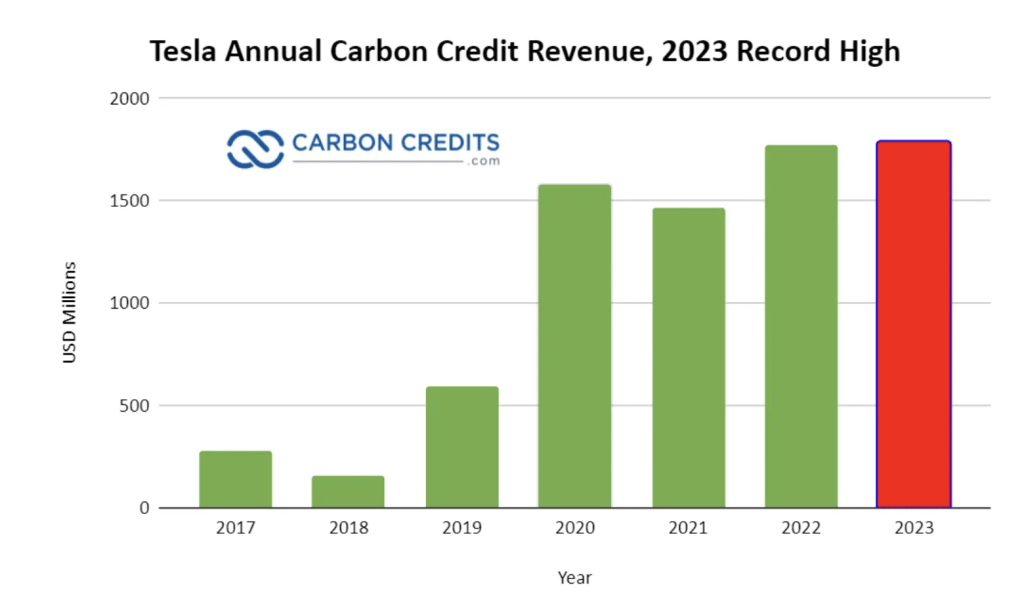

Tesla achieved $1.8 billion in sales from carbon credits in 2023

The American giants Apple, Tesla and Salesforce are each leading the way in the use of carbon credits in their own way. Apple made the Apple Watch the first 'carbon neutral' product by using carbon credits .

Tesla even sells carbon credits, last year for a record amount of no less than 1.8 billion , bringing the total turnover that Tesla has achieved from carbon credits since 2009 to almost nine billion dollars.

Salesforce is the largest employer in San Francisco and named sustainability as its fifth core value in 2022 . The company announced it would spend $100 million on carbon credits and even opened its own marketplace for carbon credit projects.

To my dismay, Salesforce's Chief Impact Officer Suzanne DiBianca admitted on Tuesday during the Climate Summit that the carbon credits market is still so in its infancy that after purchasing carbon credits, the company receives PDFs as transaction receipts, with a few spreadsheets if all goes well. . Each registry (such as Verra, Gold Standard or American Carbon Registry) also uses its own classification system of carbon credits, making standardization and comparison difficult, if not impossible.

Three recommendations from Oxford

A multidisciplinary team from the University of Oxford recently published an updated version of their carbon credit manual for companies, called the Oxford Offsetting Principles 'flagship guidance ' - clearly not tips from the LTS Weak- and Alternating Current from Lutjebroek.

- Prioritize reducing your direct and indirect emissions: reduce the need for compensation.

- Ensure the integrity of carbon credits: credits must be measured, reported, verified and properly accounted for. Investments that generate credits must demonstrably lead to additional results that would not have been achieved without that investment, have a low risk of relapse and avoid a negative impact on people and the environment.

- Ensure transparency – Make public your current emissions, accounting and verification practices, targets and transition plans to achieve net zero, as well as the type of credits you use, your selection process and the verification processes associated with the credits.

You can already feel it coming: as far as I know, there is virtually no company in the world that adheres to these recommendations. Precisely making it public, the third recommendation, should be legally required, just as annual figures must be published.

A world to be won for blockchain

Naturally, companies must take care of reducing their emissions themselves. But precisely when recording, reporting and accounting, the transparency and 'immutability' ( immutability in blockchainspeak) of blockchain can be of crucial value for the entire carbon ecosystem.

The most important thing is that the source, the 'cause' of the CO2 removal, is clearly visible and the removal is permanent. The right use of blockchain technology can create a market where, to cite an example mentioned earlier, airlines pre-finance the development of sustainable aviation fuel (SAF), as Velocys is paid by Southwest Airlines. Then governments do not have to step in and only increase the pressure by increasing taxes on carbon emissions.

Crypto meets climate

The UN climate conference COP28 was recently held in Dubai, where crypto conference Token 2049 took place this week. At the same time, Ecosperity Week was organized at the iconic Marina Bay Sands in Singapore, where the Asian edition of Token 2049 will be held in September, not entirely coincidentally, just before the Formula 1 race. Perhaps the fact that crypto events take place in the same place as climate conferences underlines that they are not as different worlds as is often thought.

Climate played a major role in the days leading up to Token 2049, when persistent rain showers in the Gulf region caused massive flooding in Dubai and air traffic experienced major problems. Preparations for Token 2049 also literally fell through with flooded exhibition stands , but the event took place without any other major problems.

Symbolic halving moment

It was almost symbolic that the most recent Bitcoin halving took place on Friday during Token 2049. The Zeeland-Turkish crypto icon Meltem Demirors explained on CNBC why the halving is important.

While the focus of the halving is of course on the expected price increase of Bitcoin, which has already been spectacular since the Bitcoin ETFs attracted more than ten billion dollars from investors this year, the halving also has an interesting 'energy effect'.

Because Bitcoin miners earn less after the halving, costs will again be closely examined. As a result, according to Demirors, it is expected that miners will look for lower energy costs, more sustainable energy and will also switch on their machines during off-peak hours on the energy network. Hopefully this will reduce Bitcoin's CO2 emissions .

Demirors points out that it is unusual that Bitcoin reached a new high in March, right before the Bitcoin halving, while in the last two halvings, Bitcoin's new high was reached nine to 12 months after the halving. That is why she doubts whether Bitcoin, as many expect, will quickly rise to a new record price towards one hundred thousand dollars.

The crypto market is currently moving mainly sideways, and it seems as if investors are waiting for major price swings after the halving. Only XRP rose unexpectedly fast this week: no less than 22% .

Seen from a slightly greater distance, it is important to follow the movements of the very big money. Then it is noticeable that BlackRock, the world's largest investor with ten trillion (ten thousand billion) dollars of invested assets, has become very active in both markets: Bitcoin and carbon removal technology.

Read also:

[Column] Michiel Frackers: Smart tips, tricks and hacks for a better life

[Column] Michiel Frackers: Nvidia passes Google and Amazon, in a week full of AI blunders

![[Column] Michiel Frackers: Sense and nonsense of carbon credits and Bitcoin halving](Article Images/Key Persons/Michiel_Frackers_Marketing_Report.jpg)