Decarbonization, the removal of carbon, has become a critical tool in the fight against climate change, but it also shows promise as a means of global economic acceleration.

If that doesn't sound like a sentence I can easily roll out of my keyboard, then that's right: it's a quote from McKinsey's excellent report: 'Carbon removals: how to scale a new gigaton industry.' I had missed this report from December last year until I listened to this fascinating podcast from McKinsey folks last week and looked for more information.

McKinsey focuses on CO2 removal

The ever-critical McKinseyians probably think that I am shortchanging their research in my summary, but a few conclusions can be drawn from their report and the podcast:

- Carbon credits play a crucial role in achieving the goals of the Paris Climate Agreement (COP21). Carbon credits allow companies to offset their emissions and achieve climate neutrality. For every ton of CO2 that a company reduces or prevents, a credit can be issued that is traded on the carbon market. This stimulates innovation and green technologies.

- There are serious doubts about the quality of many of the current carbon credits, especially the old-growth forest type where credits are issued for not cutting down trees that have been there for years.

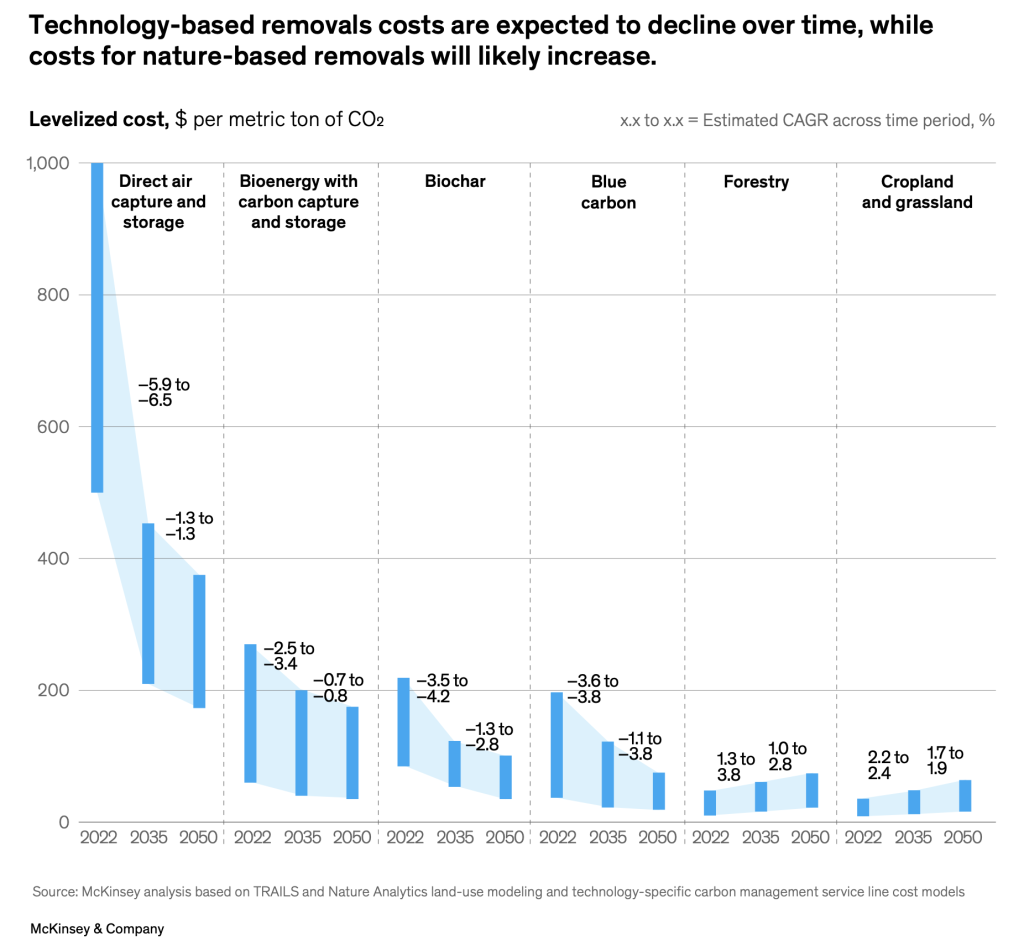

- Technology-based disposal methods are becoming increasingly important and even cheaper than natural solutions such as reforestation.

- The capacity for CO2 removal (called CDR, for carbon dioxide removal ) is still far from the required gigatonne scale to achieve a CO2 neutral world around 2050.

- There is a need for greater transparency in verifying the authenticity and duration of carbon removal, increasing liquidity for more efficient trading, and standardizing quality and validation processes across markets. Addressing these issues will increase the integrity of carbon credits, reduce skepticism and expand the market.

- McKinsey wouldn't be McKinsey if the report they produce didn't concern a gigantic market: and yes, according to the critical McKinsey minds, this CDR market for technology that removes CO2 will be no less than $1.2 trillion in size : twelve thousand billion. In 2050, yes, but I'm holding them to it.

Excited about Tracer

In all honesty, I am so excited about McKinsey's report and podcast because I am supporting a project that addresses the exact issues identified and helps develop what McKinsey believes will become a new gigaton industry: Tracer .

Tracer is the answer to the question: how do you scale the carbon credit market from small, opaque and without liquidity, to huge, transparent and liquid? That is special, because so far the solutions have been either liquid or transparent. Either efficient or reliable.

Tracer solves this with the elegance of one smart contract, which - it must be said - makes the most of what is currently possible in terms of smart contracts. For enthusiasts: the “secret sauce” is the combination of a fungible and a non-fungible token in the same smart contract, making it possible to offer buyers one portfolio with multiple projects as a source of carbon credits.

Compare it with a 'basket' of shares held by fund investors. Buying carbon credits from different sources in this way has not been possible until now, making this market a hell for companies purchasing large amounts of credits.

Persistence is key

For example, last week during the GenZero Summit in Singapore, Salesforce's Chief Impact Officer Suzanne DiBianca lamented that when purchasing millions of dollars worth of carbon credits, she receives 'a few PDFs and, with a bit of luck, an Excel spreadsheet' as documentation . As if it were 1998, but in a billion-dollar market!

What I think is special about Tracer is that it offers large buyers such as Salesforce a solution that provides the requested full transparency, through an assessment model based on ' persistence '; this refers to the duration of the carbon removal. Choosing persistence as the most important factor - because some projects ensure removal for a hundred years and others for ten thousand years - also ensures that large amounts of CO2 removal credits are easily comparable and therefore tradable.

Combine that with an easy-to-understand business model to build out the ecosystem (a percentage of the number of carbon removal credits created when using the smart contract) and reward holders of the TRCR governance token for their contributions, and you have a proposition that makes me feel better.

Please call me

I'm not just sharing this because it's rare that I agree so wholeheartedly with the McKinsey people, who often excel at accurately predicting the future with hindsight. I mean: just look for a McKinsey report from, say, 1994 that predicts the breakthrough of the Internet... exactly. But I digress.

Because I'm sharing this information today because Tracer offers the opportunity to participate for an early movers fee before May 31 , which is apparently blockchain speak for 'cheap price if you're quick', before the public sale starts this summer.

The first information about how you can participate with Tracer can be found here in Dutch and here in English . I know the international team, which is led by Chief Business Officer Gert-Jan Lasterie (Flabber, Coolblue, Mediahuis and author of this standard work on cryptocurrencies) and also consists of specialists from the US, France, Singapore and Taiwan.

Do not hesitate to contact me, because although I am not an expert in this matter, I would like to explain why I support Tracer so fanatically and invite people to do the same.

Spotlight 9: Apple shares rise despite sales decline

“The lines at Apple's flagship store in Union Square and other locations around the world used to be endless, with hordes of eager customers camping out for days to be among the first to get their hands on the latest products. Ten years ago, the Apple hype seemed unstoppable as the company unveiled a steady stream of gadgets.

Today, however, Apple is at a crossroads. As the Cupertino, California-based company struggles to revive consumer enthusiasm for its products over the past decade, Apple reported its biggest quarterly revenue decline in more than a year.”

Both Reuters and the Washington Post are straining to explain how Apple shares rose after the quarterly figures announced that sales had fallen again; by four percent even compared to a year earlier, to $90.75 billion. However, net profit only fell by two percent, to $23.64 billion. Analysts deduced that Apple's increased profitability is because the company has become more efficient. Still, the question for Apple is: ' What's next ?'

Crypto scrambles to his feet

Bitcoin appears to be missing from the graph above, but the price change was less than one percent and that is not visible to the naked eye. Ethereum fell more, but looking at the week as a whole, crypto enthusiasts will be pleased that Bitcoin climbed back above $60,000 and Ethereum rebounded above $3,000.

Some tech analysts are convinced that altcoin season is upon us, but less optimistic souls are concerned about the US SEC's attempt to classify Ethereum as a security, an investment. That's nonsense, but more about that later in the podcast, which is scheduled to launch in June.

Short news

- Elon Musk turns X, the former Twitter, into a news source .

“Musk shared a deeper vision for the product, which he wants to build into a real-time synthesizer of news and reactions on social media. Effectively, he wants to use AI to combine breaking news and social commentary around big stories, present the compilation live and let you go deeper via chat.

“As more information becomes available, the News Feed will be updated to include that information. The goal is simple: to provide maximum accurate and timely information, citing the most significant sources.”

I'm very curious to see what news à la Musk will look like. It was not all hosanna for him this week, because Tesla's margin is now 5% due to all the price reductions, much lower than the norm in the car industry. Furthermore, key employees were dismissed , which remains unsettled around the company.

- LinkedIn founder Reid Hoffman, also an investor in virtually every successful AI company, made a deepfake of himself and the video is so lifelike it's scary. I was so mesmerized by the technology that I barely noticed what Hoffman's message was.

- Tim Cook (Apple) and Satya Nadella (Microsoft) visited Indonesia

During a visit to Indonesia, Microsoft CEO Satya Nadella announced that he will train as many as 840,000 people in the country in the use of AI and will invest $1.7 billion in cloud services. With both numbers the question arises: how did they arrive at this number?

Apple CEO Tim Cook was also recently in Indonesia , where President Joko Widodo tried to convince him to build a factory, so far without success. Indonesia could benefit from difficult American-Chinese relations with an Apple factory.

- Startup incubator Techstars in de problemen

Layoffs, cutbacks and intrigue at incubator Techstars, according to this revealing report .

- Most popular iPhone app in America: old games!

Banned from the app store for a long time, but can now be downloaded for free: Delta . Play Super Mario and other old Nintendo Gameboy games on the iPhone.

Dating app Bumble became famous because men had to wait for women to make first contact. Fortunately, few men held their breath until they received a message. That restriction on male initiative has now been abolished with the introduction of a new feature called “ opening moves ”. It allows female users, also colloquially known as women, to set a prompt that male suitors can respond to to start a conversation.

Donkey Kong on your iPhone or make your opening moves on Bumble, I hope I gave you something to do today.

![[Column] Michiel Frackers: A gigaton industry: CO2 removal](Article Images/Key Persons/Michiel_Frackers_Marketing_Report.jpg)